Company Information

Background

PSG Corporation Public Company Limited ("the Company"), formerly known as “T Engineering Corporation Public Company Limited”, is a multifaceted construction company offering a wide range of services, including civil engineering, installation, system engineering, and other EPC services. The Company has a proven track record of more than 40 years and has been well-known in the industry. Furthermore, it has also been certified by ISO Certification Institute (MASCI) for ISO 9001: 2015.

The Company has delivered construction projects for both government agencies and private companies, including Thai Airways International, Siam Cement Group, and Thai Beer (1991) Group. Furthermore, the Company is recognized for its ability to complete construction projects within the time frame specified and in accordance with the terms and conditions of contracts with partners and financial institutions, ensuring that the interests of all stakeholders are well served.

Message from the Chairman and CEO

MR. VAN HOANG DAU

Chairman of the Board of Directors

MR. DAVID VAN DAU

Chairman of Executive Committee

Dear Shareholders, Stakeholders, and Partners,

As we reflect on the past year, PSGC has navigated challenges, achieved significant milestones, and laid a robust foundation for the future. In 2023, PSGC’s construction contracts remained on schedule adding to the Company’s profitability, in addition, the Company was able to secure a new construction project bringing the accumulated backlog to over 10,000 MB. These accomplishments have generated substantial revenue, positive cash flow, and profitability in a relatively short period of time providing a solid groundwork for PSGC’s continued journey.

Our commitment to progress is unwavering. On the corporate front, we have implemented progressive policies, enhancing employee compensation and benefits, fostering a competitive and well-rounded workforce. Initiatives to upskill our teams through training and recruitment of fresh talent are underway bringing in new perspectives and opportunities. Risk assessments and rigorous internal control policies have been updated, emphasizing our dedication to accountability and transparency.

Recognizing the evolving landscape, PSGC acknowledges the need for strategic shifts on the business front. While we continue to execute construction and engineering contracts, the changing landscape necessitates diversification in order to enhance shareholder value. The Company has built a well rounded business development team of analytical thinkers with experience in a wide range of industries, allowing the Company the ability to explore and assess a myriad of opportunities that will bring the highest returns to our shareholders. A strong business development team, coupled with the Company’s current stable cash position provides a firm foundation to take advantage of such opportunities.

Diversification into Renewable Energy:

Building upon PSGC’s construction expertise, we have strategically expanded into promising new markets for long-term growth. Driven by the global imperative to transition towards cleaner energy sources, we explore diversification into renewable energy solutions. The Company has commissioned feasibility studies for solar power and pumped storage hydropower (PSH) projects in the Lao PDR to strategically position PSGC and enable it to capitalize on the growing demand for renewable energy integration and grid stabilization in the region, aligning with current ESG trends. Although PSH is still in the early stages of development for the CLMV region, we remain steadfast in development of the opportunity as neighboring countries look to decarbonize to a greener future.

M&A Opportunities:

To drive long-term expansion strategies and sustainable growth, PSGC continues to pursue mergers and acquisitions (M&A). These include construction or related sectors, or other sectors which will ultimately enhance shareholder return and will bring about sustainable growth. PSGC is receptive and has also been pro-actively exploring several investment opportunities in Thailand and the wider ASEAN region.

In closing, we express sincere gratitude to all stakeholders, reaffirming our commitment to delivering a company with robust fundamentals and long-term growth potential. Now that the Company is in stronger financial health and armed with a capable business development team, PSGC is poised and ready to accelerate our growth towards business sustainability!

Thank you for your continued trust and partnership.

Best Regards,

Nature of Business

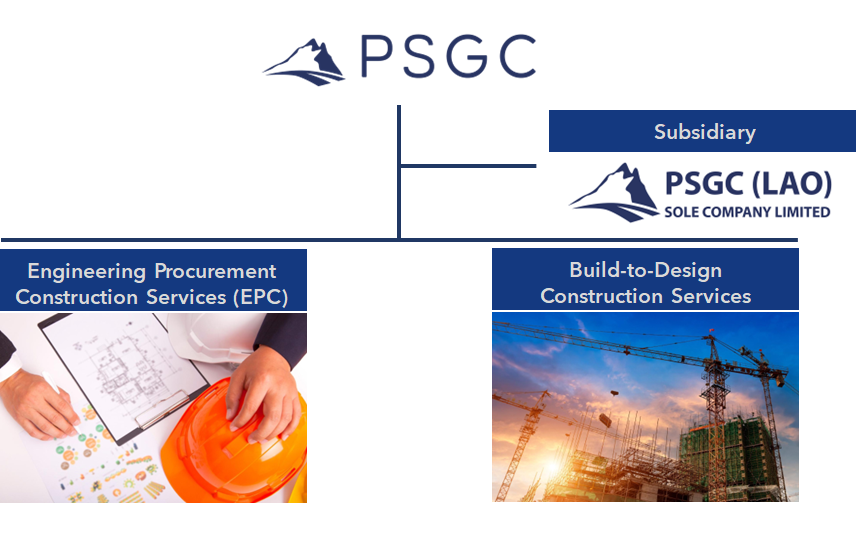

Business Structure

PSG Corporation (Public) Company Limited offers construction services for projects in the Engineering Procurement Construction (EPC) or Lump Sum Turnkey (LSTK) categories and construction work for large-scale projects. The Company can undertake jobs both domestically and internationally within the ASEAN region. The Company's business can be divided into two main types, as follows:

Engineering Procurement Construction Services - EPC

The Company offers a comprehensive range of EPC project services that include initial design work, detailed design work in engineering, procurement of materials, tools, and machines, and complete construction, including testing before delivery to customers. The Company provides these services for industrial plants, power plants, petrochemical plants, large buildings, and various infrastructure works such as roads, bridges, electricity distribution, and water supply systems.

Build-to-Design Construction Services

The Company offers construction services for projects in the category of construction contractors according to customer-approved drawings. These services are accepted and satisfied by various industries, including industrial factories, petrochemical plants, hospitals, etc. The Company strongly emphasizes delivering high-quality products to customers, meeting delivery deadlines, and utilizing a certified service-based system with construction project management. The Company has satisfied customers by adhering to the ISO9001:2015 standard.

Board of Directors

Executives

Sub-Committees

Organizational Structure

Financial Highlights

(Unit: THB million)

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Statement of profit and loss | |||||

| Revenue | 392.02 | 113.62 | 44.58 | 1,050.30 | 2,750.75 |

| EBIT | -88.64 | -22.26 | -60.08 | 562.95 | 1,659.38 |

| Net profit | -91.01 | -22.67 | -63.13 | 540.46 | 1,316.42 |

| EPS | -0.009 | -0.002 | -0.003 | 0.008 | 0.020 |

| Statement of financial position | |||||

| Cash | 44.80 | 19.07 | 1,061.09 | 616.02 | 1,298.38 |

| Total assets | 649.69 | 288.16 | 1,291.55 | 1,947.88 | 3,933.35 |

| Total liabilities | 482.54 | 125.41 | 91.21 | 209.72 | 876.35 |

| Shareholders' equity | 167.15 | 162.76 | 1,200.34 | 1,738.16 | 3,057.00 |

| Financial ratios | |||||

| Debt/Equity | 2.89 | 0.77 | 0.08 | 0.12 | 0.29 |

| Net profit margin | -23.22% | -19.95% | -141.61% | 51.46% | |

| ROA | -11.81% | -4.75% | -7.61% | 34.76% | |

| ROE | -42.18% | -13.74% | -9.26% | 36.78% | |

| Statistics | |||||

| P/E | 9.49 | - | - | 176.61 | 71.34 |

| P/BV | 1.77 | 2.61 | 293.07 | 49.87 | 18.87 |

| Book value | 0.03 | 0.02 | 0.01 | 0.03 | 0.04 |

| Closing price | 0.05 | 0.04 | 0.58 | 1.30 | 0.67 |

Quarterly Results

Annual Report

Information for Shareholders

Shareholders’ Meetings

Warning: Invalid argument supplied for foreach() in /home/vhprojec/domains/psgcorp.co.th/public_html/frontend/investor_relations.php on line 1054

General Information

| Company name | PSG Corporation Public Company Limited |

| Nature of business | Construction Contractor Engineering Procurement Construction (EPC) Civil Engineering and Engineering Systems |

| Head office location | 11/1 AIA Sathorn Tower, 21st Floor South Sathorn Road Yannawa, Sathorn, Bangkok 10120 |

| Registration number | 0107548000501 |

| Registered capital | THB 64,992,438,156.00, with a par value of THB 1.00 per share |

| Paid-up capital | THB 64,992,438,156.00, with a par value of THB 1.00 per share |

| Total number of shares | 64,992,438,156 shares |

| Website | www.psgcorp.co.th |

| Telephone number | +662-018-7190-8 |

| Fax number | +662-018-7199 |

| Company secretary | Tel : +662-018-7190-8 Fax : +662-018-7199 Email : com.sec@psgcorp.co.th |

| Investgor relations | Tel : +662-018-7190-8 Fax : 02-018-7199 Email : ir@psgcorp.co.th |

Subsidiary

| Company name | PSGC (Sole) Company Limited |

| Nature of business | Plant and Building Construction and other related services |

| Head office location |

PT Building, 6th floor, Phonexay Road,Phonexay Village, Xaysettha Distric, Vientiane Capital, Lao PDR, Lao Box: 7591 |

| Registered capital | LAK 16,000.00 Million (Approx THB 45.00 Million) |

| Telephone number | +856 20 5629 8998 |

References

| Securities Registrar | Thailand Securities Depository Co., Ltd. No. 93 Ratchadaphisek Road, Din Daeng, Bangkok 10400 Tel: +66 2009 9000 Fax: +66 2009 9991 |

| Auditor’s Office | EY Office Limited 33rd Floor, Lake Rajada Office Complex, 193/136-137 Rajadapisek Road, Klongtoey, Bangkok 10110 Tel: +662 264 9090 Fax: +662 264 0789 |

Major Shareholders as of March 12, 2024

| Names | No. of shares | % |

| 1. Ms. Panicha Dau | 25,997,000,000 | 40.00 |

| 2. Bank Julius Baer & Co. Ltd, Hongkong | 25,297,000,000 | 38.92 |

| 3. Thai NVDR Company Limited | 3,648,988,980 | 5.61 |

| 4. Mr. Adisorn J.Jitcharoenchai | 990,997,100 | 1.52 |

| 5. Miss Chanida Sae-Tang | 779,470,900 | 1.20 |

| 6. Mrs. Leena Rachitratanaying | 554,551,000 | 0.85 |

| 7. Mr. Pornprom Promvanich | 546,475,800 | 0.84 |

| 8. Mr. Prasit Chongussayakul | 511,002,852 | 0.79 |

| 9. Mr. Chayut Phibunlaphatroj | 473,000,000 | 0.73 |

| 10. Mrs. Anchan Chongussayakul | 273,830,000 | 0.42 |

Presentation

Warning: Invalid argument supplied for foreach() in /home/vhprojec/domains/psgcorp.co.th/public_html/frontend/investor_relations.php on line 1054

Dividend Policy & Payment

Dividend Policy

The Company pays dividend at least 50% of net income. However, payment of dividend is dependent on operating results, business plans, liquidity, necessity and other future obligations or commitments. Decisions regarding dividend payment is to be made by the Board of the Company by taking into consideration the best interest of its shareholders.

Dividend Payment

|

Year |

Earnings per Share |

Payment: |

Payment Date |

Interim Payment: |

Payment Date |

|---|---|---|---|---|---|

| 2022 | 0.020 | - | - | - | - |

| 2022 |

0.008

|

-

|

-

|

-

|

-

|

| 2021 |

(0.003)

|

-

|

-

|

-

|

-

|

| 2020 | (0.002) |

-

|

-

|

-

|

-

|

| 2019 | (0.009) |

-

|

-

|

-

|

-

|

| 2018 | (0.019) |

-

|

-

|

-

|

-

|

| 2017 | (0.012) |

-

|

-

|

-

|

-

|

SET Disclosures

Investor Inquiry

Investor Relations Division

PSG Corporation Public Company Limited

11/1 AIA Sathorn Tower, 21st Floor South Sathorn Road, Yannawa, Sathorn, Bangkok 10120

Tel: 02 018 7190 – 8 ext. 789

Fax: 02 018 7199

Email : ir@psgcorp.co.th